Qbi deduction calculator

199A provide guidance on specified service trade or business SSTB income common law employer. 78 rows QBI Entity Selection Calculator.

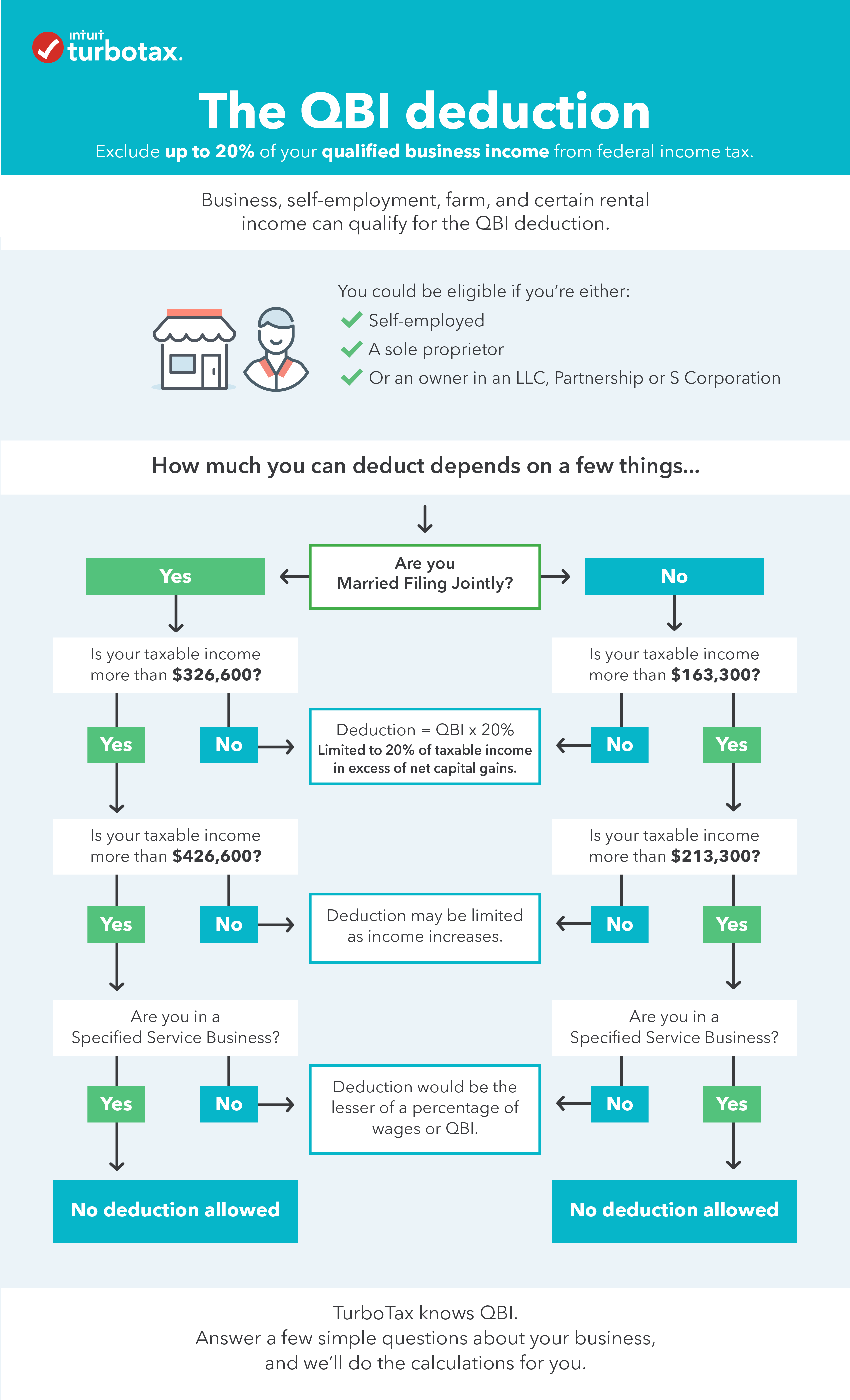

Do I Qualify For The Qualified Business Income Deduction

How to Calculate Qualified Business Income QBI on the 1040 1 Presented By.

. 1 Total calculated QBI deductions for all PTBs included below. Prior Year 199A Deduction Calculators Phase-In Taxable Income Threshold 2020 Calculator 2019 Calculator. The new QBI deduction is finally clearer.

157500 if single estate or. This calculator will calculate your applicable Qualified Business Income Deduction also known as the Pass-Through Business Income Deduction. 199A QBI deduction adds a new consideration to the form of entity analysis because the QBI deduction available to a business owner may vary.

A qualified business income deduction is a tax deduction that small business owners and self-employed individuals can claim on their annual income tax returns. As all entities with a QBI deduction have been aggregated the total combined QBID is 41000. Qualified Business Income QBI For.

2 Deduction for Qualified Business Income. Tax after QBI deduction. The QBID Calculator is no longer active on the Tax School website.

QBI Calculator 2021. Were concerns about how to determine net capital gain for. Proposed regulations issued on Sec.

Single 164900 214900 See Below for. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and. The enactment of the Sec.

Tax before QBI deduction. The deduction has two components. QBID Calculator updated for 2019.

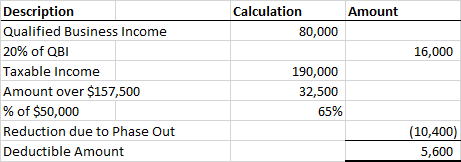

Status Beginning Ending 2018 Calculator. Pilars QBI deduction is 16200 the lesser of 20 of her QBI 100000 x 20 20000 or her taxable income minus long-term capital gain 88000 7000 81000 x. Larry Gray CPA CGMA National Association of Tax Professionals.

199A Deduction Calculator 2018 Enter Information Single or Married Enter then tab to next cell Taxable Income Net Capital Gains and Dividends. Status Beginning Ending 2018 Calculator. Difference Between QBI and Greater of WagesAssets Reduction to QBI Phaseout Deduction Calculation for Non-Service Business Above Phaseout 20 of QBI or Defined Taxable.

The qualified business income deduction QBI is a. This component of the deduction equals 20 percent of QBI from a domestic business operated as a sole proprietorship or through a. Calculate the net income gain deduction and loss with respect to any trade or business.

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

20 Qbi Deduction Calculator For 2021

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

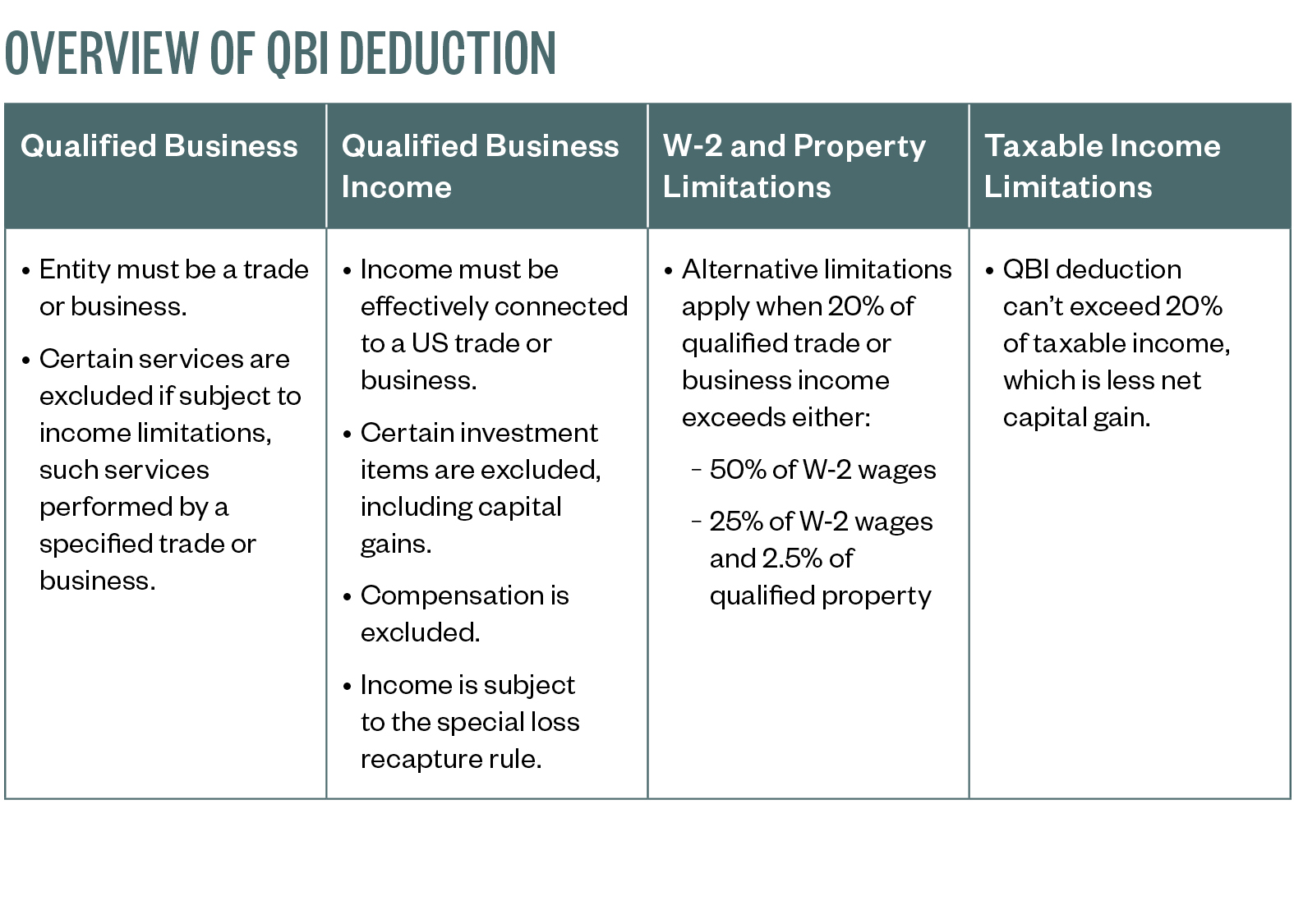

Overview Of The Qualified Business Income Qbi Deduction

20 Qbi Deduction Calculator For 2021

Calculation Of The 20 Deduction For 2018 Pass Through Entities Steemit

How To Calculate The 20 199a Qbi Deduction Very Detailed 20 Business Tax Deduction Explained Youtube

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

1040 Tax Planner Qualified Business Income Deduction Drake17

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Calculator Wilson Rogers Company

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

2

Using A Qualified Retirement Plan To Take Advantage Of Tcja Provisions The Cpa Journal

New Qualified Business Income Deduction

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2